Please see our Risk Disclosure and Performance Disclaimer Statement. Important Disclaimer: The information provided on this page is strictly for informational purposes and is not to be construed as advice or solicitation to buy or sell any security. Wave 2: In Elliott Wave Theory, wave two corrects wave one, but can never extend beyond the starting point of wave one. Bid/Ask - Displays a numerical view of the bid and ask volume using the. Volume might increase a bit as prices rise, but not by enough to alert many technical analysts. Or go to the top menu, choose Add Study, start typing in this study name until you see it appear in the list, click on the study name, click OK. Volume Imprint Profile - Displays a volume histogram using the given price interval.

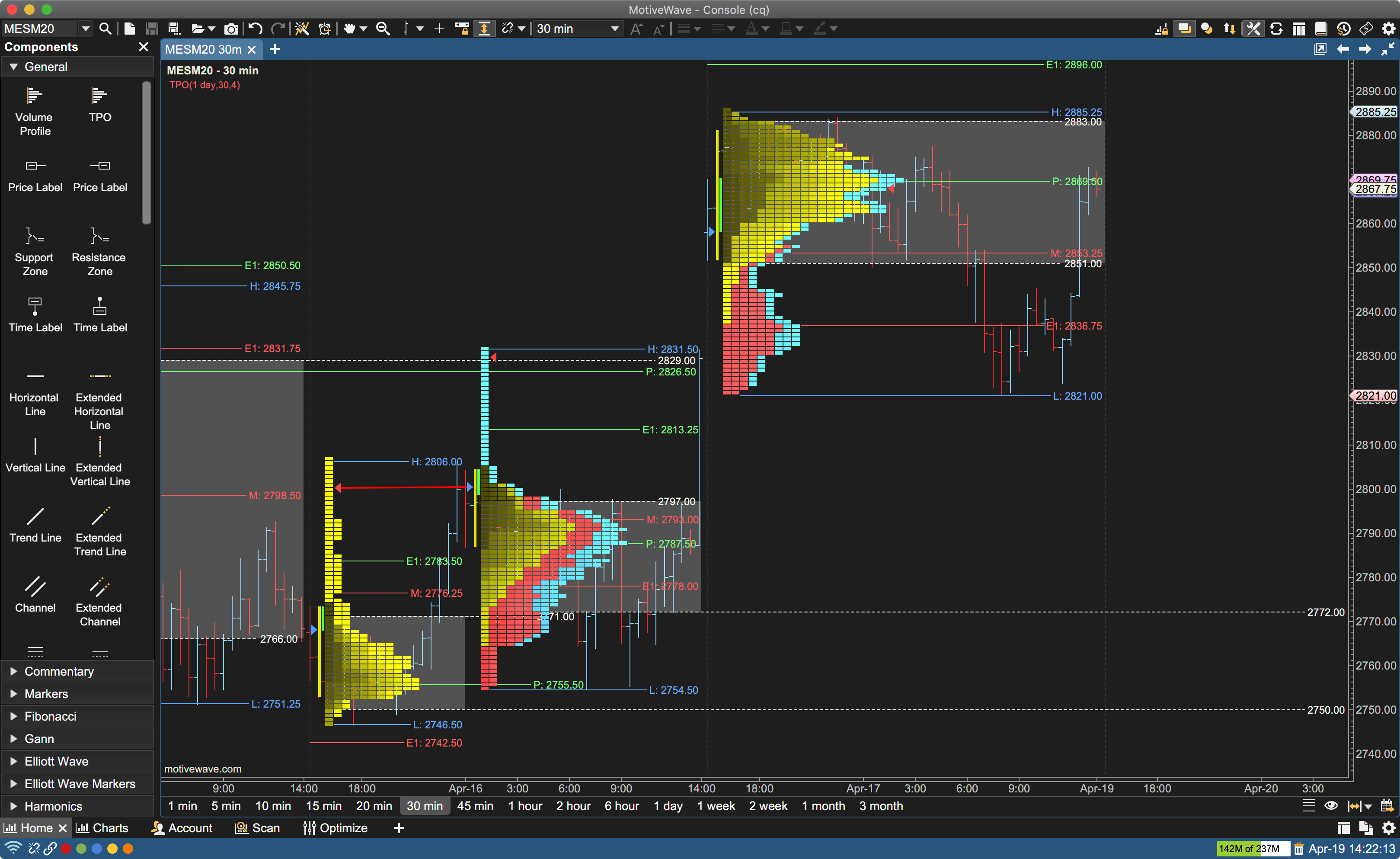

#Motivewave volume at price software#

Go to the top menu, choose Study>Volume Based>Volume Profile MotiveWave Volume and Order Flow Analysis Guide MotiveWave Version 6.0 ©2019 MotiveWave Software of 89 Imbalance (diagonal) A buy imbalance occurs when ask volume at a given price is higher (by a given percentage) than the bid volume at one price level below (sometimes known as diagonal imbalance). No trading signals are calculated for this indicator. This indicator’s default values are given in calculation below. Volume tiers are applied based on monthly cumulative trade volume summed across all. The user may change the number of bars, width, align, range percent and show range option. The Volume Profile displays a vertical representation of the volume distribution over the price range for the visible bars. Our High Volume Tiered pricing decreases as your volume increases. Definitely Elliot wave lovers will fall in love with this feature.Įlliott Wave Study – The Auto Analyze feature implemented as a study ( Study>Overlays>Elliott Wave).The Volume Profile displays a vertical representation of the volume distribution over the price range for the visible bars. Check out the sample nifty spot hourly charts with auto elliotwave study. Range bars are based on price movements of a specific price range. Linear time interval based bars (such as 1 minute, 15 minute, 1 day, 2 week etc) 2.

MotiveWave supports several different types of bars: 1. When the natural movement of prices is bound by time, the trend still remains visible. Bar sizes are useful for changing the resolution of a chart based on time, price or volume movements. Out of that what impressed me is Elliott Wave Study – The Auto Analyze feature. Prices do not unfold in bundles of equal time. (Disclaimer : The above chart shown is for study purpose only and not for trading decision)

or go to the top menu, choose Add Study, start typing in this study name until you see it appear in the list, click on the study name, click OK.

I should i have to say that this time motivewave had come with more innovative features like Elliott Wave Study – The Auto Analyze feature, Point & Figure Bars, GANN Enhancements such as Pyra Points and Cross Square. Go to the top menu, choose Study >Moving Average>Volume Weighted Average Price.

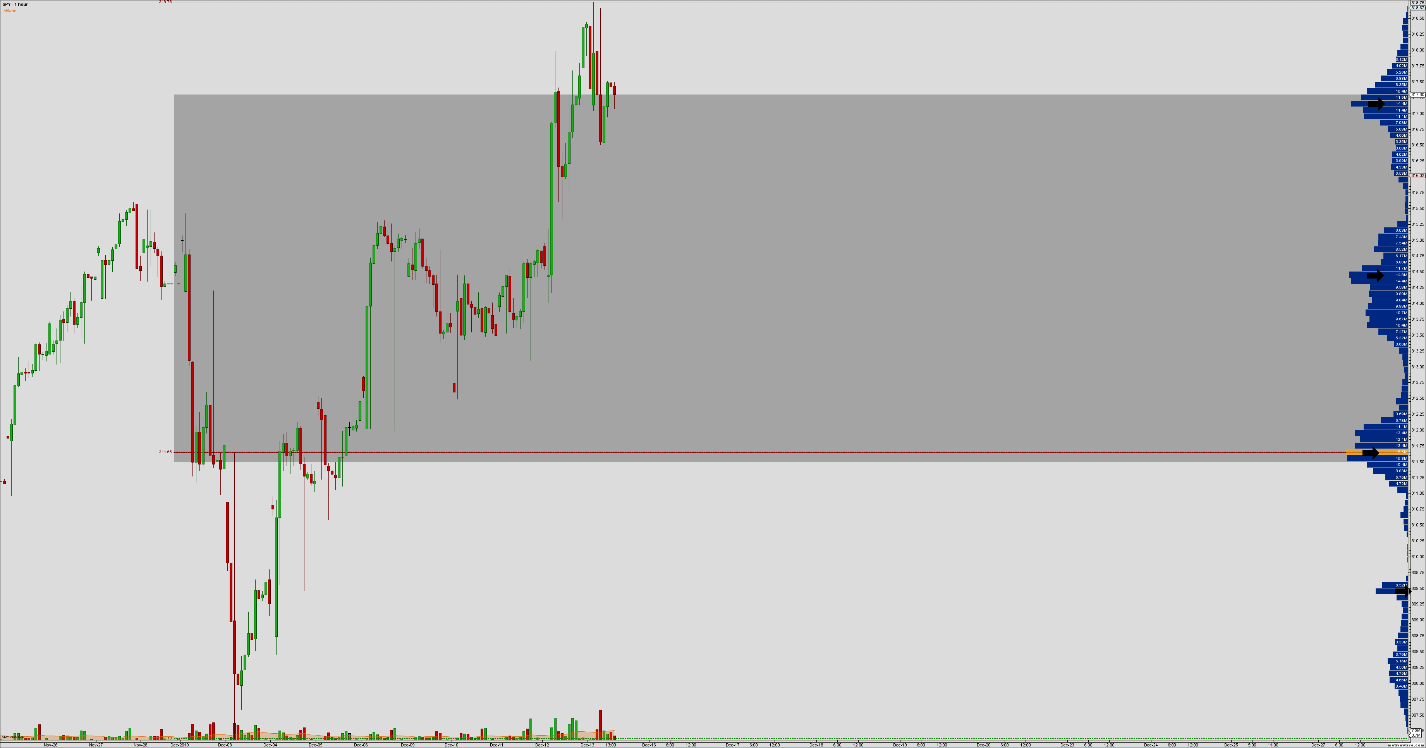

The key level of the price range and resistance level. VAH Value Area High the upper boundary of the Value Area. The VAL is RUB 111,590 in Pictures 6 and 7. Just testing with the new features released with Motivewave version 2.4. When the price approaches this level, the trader focuses on the market behavior by horizontal volumes whether the price would break the VAL level or would turn upwards.

0 kommentar(er)

0 kommentar(er)